MINT: China's Real Estate Crisis

24 Feb 2024 | Andrei Dimaculangan, Jared Go, Antonio Panis, Ethan So, and Elijah Soriano (Ateneo MECO)

MINT

Macro, Insights, News, and Trends

As China solidifies its position as the world’s second largest economy, the role of their market in the global economy has been increasingly noticed.

Historically, one of their biggest GDP contributors comes from their real estate sector, a key driver of economic growth. It plays an essential role in their economy, with approximately 30% of their GDP being allocated to investments in properties and infrastructure (Pettis, 2022). However, this reliance on real estate has raised concerns about the sustainability of their economic growth. China has already foreseen some problems and difficulties, which is why their government created and implemented the “three red lines.” These are guidelines establishing a limit of debt that a real estate company can accumulate. Recently, prominent real estate developer Evergrande filed for bankruptcy due to excessive amounts of debt. As China deals with the fallout of one of their biggest real estate companies, the effects of the real estate crisis continues to make its waves in China’s economy today.

Fundamental to understanding the crisis is the public perception of China’s real estate market. For many decades, China’s real estate market was rapidly growing fueled by a mass migration of the country’s rural population to urban areas.

There was a belief, among ordinary people, investors and developers alike, that property prices could only climb as more and more people populated its cities and demanded housing.

With this, ordinary people began using real estate as an asset they could store their wealth. With the belief of profiting from rising prices and demand, dozens of real estate developers excessively built high-rise condominiums across many cities in the country.

While the country’s real estate sector was evidently strong during the previous decade, it is imperative to note that developers aggressively financed these developments using the advanced payments of future homeowners and government loans to further expand. This debt-led growth can only work assuming that more and more people keep buying undeveloped homes. Simultaneously, there was a trend among a growing Chinese middle class who invested their hard-earned money in real estate bonds under the same belief that the property market was rock solid. This was later proven to be disastrous as developers defaulted on their debts.

Even before the liquidity crisis that faced the property market in 2020, red flags were already appearing with weakening demand, alongside a huge excess of supply. The most glaring manifestation of this was the increasing number of ghost cities popping up all around China. Ghost cities are essentially municipalities or towns that have either been abandoned. Although China’s ghost cities are not completely unoccupied, the amount of people who live in the cities is at least half of the expected occupancy. The first ghost city that was reported by Chinese state media was Changzhou back in January 2013 (Li, 2017). Since then, it has now been reported that there are around 50 ghost cities of varying sizes across China (Fleiss, 2023). As of 2021, 21% of homes in China are vacant, which is around 65 million homes (Batarags, 2021).

Marking the highlight of this crisis was the collapse of Evergrande, one of the largest real estate developers in China. Prior to delving into the dynamics behind this collapse, it is important to first look into a policy implemented in 2021 known as “The Three Red Lines.” Regulators implemented this in order to control the debt-fueled growth ongoing in the real estate sector. The Three Red Lines were the following:

-

Liability to asset ratio of less than 70% (excluding advanced receipts)

-

Net gearing ratio of less than 100%

-

Cash to short-term debt ratio of at least 1

If any of the aforementioned criteria were breached, there would be restrictions placed on the annual debt growth of the firm in question.

|

Color |

No. of Lines Breached |

Maximum annual debt growth |

|

Green |

0 |

15% |

|

Yellow |

1 |

10% |

|

Orange |

2 |

5% |

|

Red |

3 |

0% |

Source: EAC International Consulting

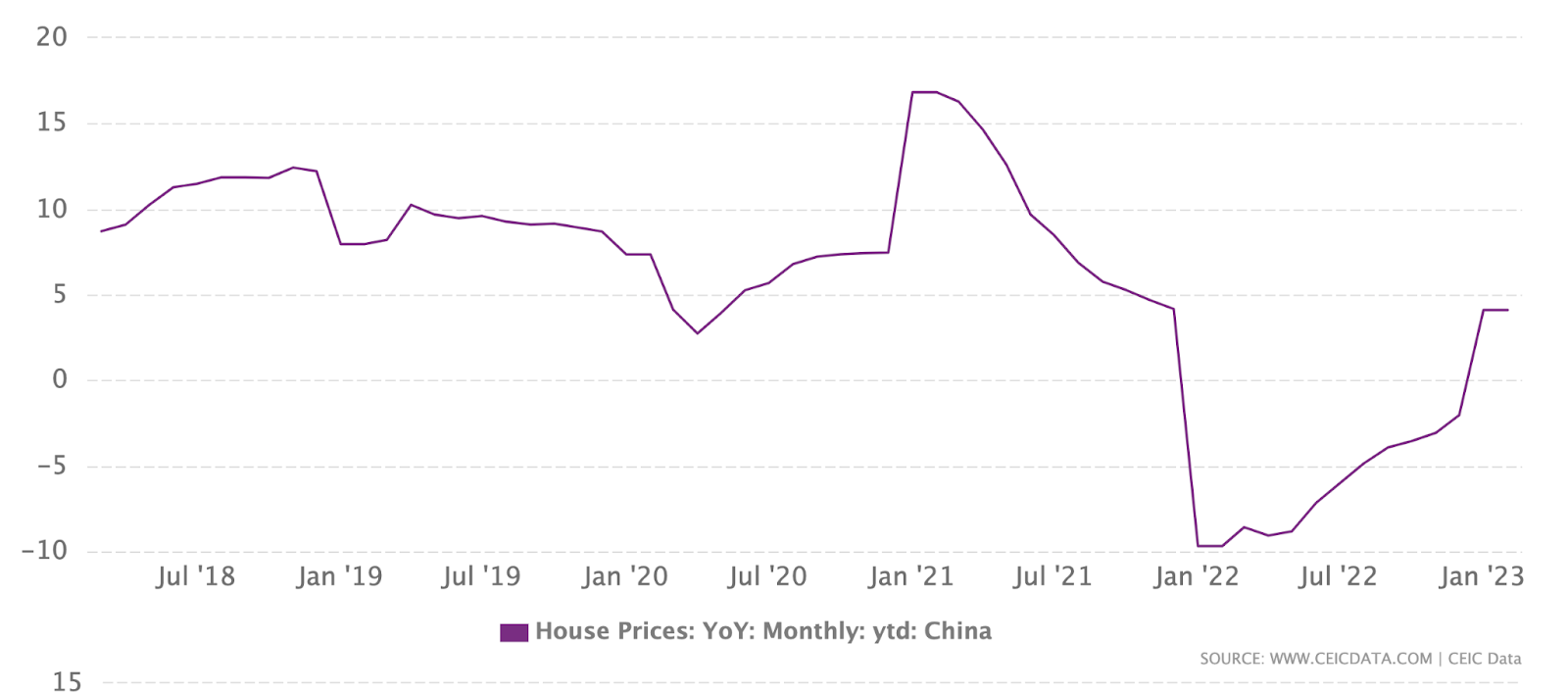

A high majority of China’s major real estate developers were unable to meet this requirement and lost access to credit. Evergrande was one of these firms. In conjunction with this widespread issue, the government advised banks to issue less mortgages which further lowered demand (Financial Times, 2022). With Evergrande being unable to refinance its debts and generate sufficient revenue, the firm eventually defaulted on its debt in late 2021. This had a negative impact on China’s real estate developer bond market which in turn led to high losses for bondholders and further tightened lending conditions. Prices were impacted as well, even going into deflation territory throughout 2022 as shown in the graph below.

With many individuals having their wealth tied to real estate, the decrease in real estate prices leads to a corresponding decline in net worth for many in China.

This makes them feel less wealthy and could lead to slower consumption growth which has been reflected in recent GDP numbers. Furthermore, another big real estate developer, Country Garden, has been showing signs of financial stress now as well.

In conclusion, China’s over-reliance on its real estate sector as a key driver of economic growth, coupled with excessive levels of debt, has led to a housing market crisis, raising concerns about the sustainability of its economic development. A weakened economy can lead to supply chain issues, given the fact that China serves as a manufacturing hub for a lot of companies and is also the world’s largest exporter of goods. As China battles with these economic challenges, the consequences of its real estate crisis are felt throughout the nation to this day.

References

Batarags, L. (2021, October 14). China has at least 65 million empty homes — enough to house the population of France. It offers a glimpse into the country’s massive housing-market problem. Business Insider. https://www.businessinsider.com/china-empty-homes-real-estate-evergrande-housing-market-problem-2021-10

China House Prices Growth. (n.d.). CEIC. https://www.ceicdata.com/en/indicator/china/house-prices-growth

Fleiss, A. (2023, March 25). How many ghost cities does China have? Rebellion Research. https://www.rebellionresearch.com/how-many-ghost-cities-does-china-have

Li, M. (2017). Evolution of Chinese ghost cities. China Perspectives, 2017(1), 69–78. https://doi.org/10.4000/chinaperspectives.7209

Evergrande: the end of China’s property boom | FT Film. (2022, March 10). Financial Times. https://youtu.be/dnp_MxXY9qs?si=6bZ_SMB_XxFk2i4J

Pettis, M. (2022, August 24). China’s Overextended Real Estate Sector Is a Systemic Problem.

Carnegie Endowment for International Peace. https://carnegieendowment.org/chinafinancialmarkets/87751

Three Red Lines Policy - Regulating China’s Real Estate Developers. (n.d.). EAC International Consulting. https://eac-consulting.de/china-three-red-lines-policy/

MINT is a newsletter published every two weeks by the Investment Strategies Department that aims to inform the organization’s stakeholders regarding macroeconomic events and concepts, and how it has affected financial markets. It serves as an avenue for project members to properly apply economic knowledge, and for IMP members to access relevant information.

Read their other articles at https://www.ateneomeco.org/mint

About Ateneo MEcO

The Ateneo Management Economics Organization (MEcO) is the premiere socially responsible investment management organization of the Ateneo. For over 3 decades, the organization has dedicated itself to empowering its stakeholders towards community development through its core competencies— financial literacy, and impact investing. MEcO continues to advocate for creating shared impact through responsible investments through the implementation of innovative and sustainable initiatives.