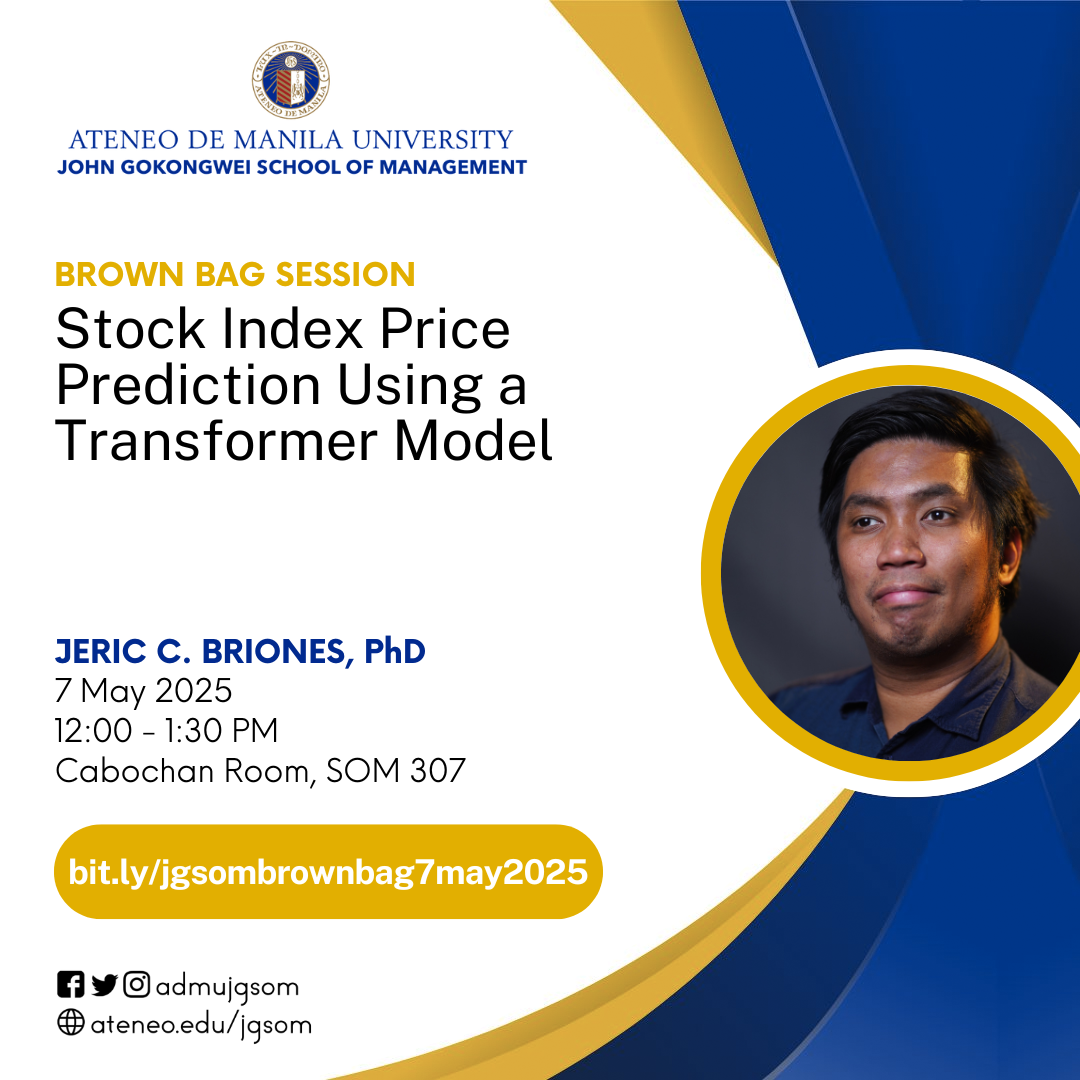

Stock Index Price Prediction Using a Transformer Model

The John Gokongwei School of Management invites you to a Brown Bag Session on “Stock Index Price Prediction Using a Transformer Model". Our presenter is Dr Jeric C Briones, Associate Chair of the Department of Finance and Accounting and Assistant Professor of the Department of Mathematics. The paper is coauthored by Albert Matthew Alejo, Jaime Angelo Nery, and Zielle Frances Realda.

This will be held on Wednesday, 7 May 2025 from 12:00 - 1:30PM at the Cabochan Room, SOM 307 and online via Zoom.

Please register here: https://bit.ly/jgsombrownbag7may2025

Brief Description of the Topic:

Driven by the growing interest in machine learning and artificial intelligence, this work explored the potential of utilizing a Transformer-based architecture to forecast the movement of the PSEi stock index. To check its feasibility, data spanning from 2010 to 2019 was analyzed with the performance of the model compared to other neural network architectures. Furthermore, to further find the limitations of the transformer model, data from other markets and other market conditions were fed into the model. A comparative analysis among the models considered highlighted the predictive capability of Transformer models for the PSEi. Additionally, evaluating the models against stock index price data from other markets and other market conditions revealed worsened performance in terms of error metrics. Regardless, these results still indicate that the Transformer model is a viable option for forecasting financial time series such as stock index prices and returns.

About the Speaker:

Dr. Jeric Briones is an Assistant Professor at Ateneo de Manila University. He earned his bachelor’s and master’s degrees in applied mathematics from Ateneo, and his doctorate degree in engineering from Nara Institute of Science and Technology, Japan. His research mainly involves time series analysis, mathematical modelling, and machine learning, with focus on applications to time series data and financial mathematics. He is also interested in stochastic analysis, operations research, and statistical learning.